Trump threatens $100 billion more in China tariffs

President Donald Trump ordered his administration to consider tariffs on an additional $100 billion in Chinese imports, sending U.S. stock futures tumbling on concern the world’s two largest economies are hurtling toward a full-blown trade war.

The move threatens to unravel efforts by top U.S. and Chinese trade officials to lower the heat and reach an agreement that could stave off an escalating conflict, after the release of a list of tariff targets earlier this week prompted immediate threats of retaliation from Beijing.

U.S. stock futures dropped on Trump’s latest trade directive to the U.S. Trade Representative. S&P 500 Index futures slid as much as 1.6 percent, after the underlying gauge ended up 0.7 percent Thursday. Asian equities were mixed, while the yen rose.

“In light of China’s unfair retaliation, I have instructed the USTR to consider whether $100 billion of additional tariffs would be appropriate under section 301 and, if so, to identify the products upon which to impose such tariffs,” Trump said in a statement issued by the White House.

A White House official later said the $100 billion figure Trump used in the statement referred to the value of the imports that would be covered by the additional tariffs, not the total amount of tax that would be charged on the products.

Xinhua, China’s state news agency, said Friday that Beijing was committed to defending its interests “against new U.S. actions.” A request for comment on the Trump statement from China’s Ministry of Commerce wasn’t immediately answered. Government offices are closed on Friday for the annual tomb-sweeping holiday.

GLOBAL REACT: Tariff Talk Is Cheap, Trade Wars Are Expensive

“This is starting to feel like the beginnings of a trade war, if simply each proposal is matched with a retaliation,” said Patrick Bennett, a Hong Kong-based strategist at Canadian Imperial Bank of Commerce. “The U.S. risks isolating itself from global trade in this process and we think the U.S., USD and U.S. asset markets have more to lose.”

China said Wednesday it would levy a 25 percent tariff on about $50 billion of U.S. imports including soybeans, automobiles, chemicals and aircraft. That was in response to the release by the U.S. of a list of proposed tariffs a day earlier, covering $50 billion in Chinese products.

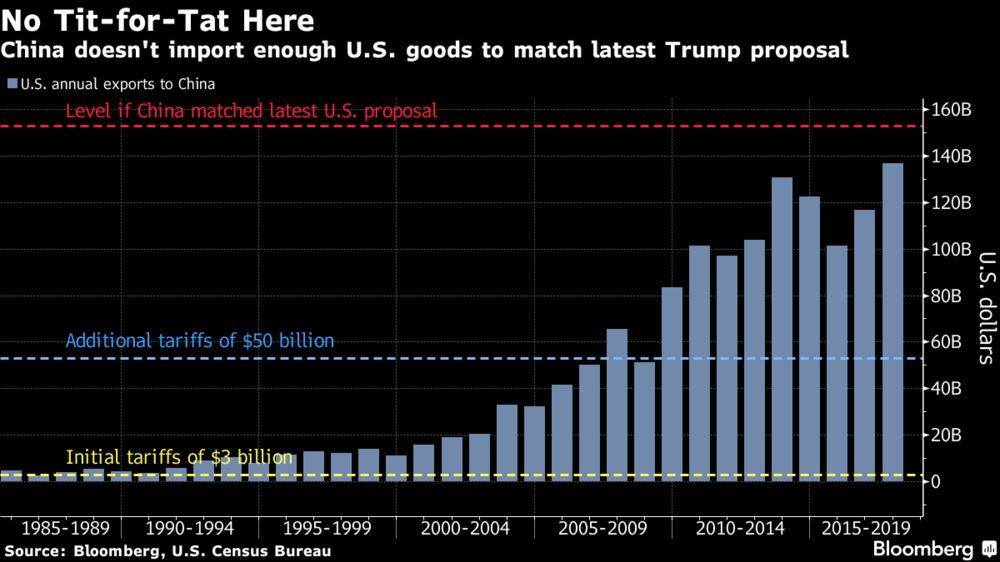

Were China to want to match Trump’s latest threat in kind, it wouldn’t have enough American goods imports to target. It could still take other measures — like curbing package tours or student transfers to the U.S., or steps against American companies’ operations in China.

U.S. Trade Representative Robert Lighthizer quickly followed up on Trump’s Thursday evening declaration with a statement of his own stressing that none of the tariffs would take immediate effect. The administration hasn’t said when any of the proposed tariffs would go into force.

He said that any additional tariffs first would be subject to a 60-day public comment period, as would the penalties announced earlier in the week.

“No tariffs will go into effect until the respective process is complete,” Lighthizer said.

Trump’s newly installed chief economic adviser, Larry Kudlow, and other administration officials have spent the past two days trying to tamp down fears of a trade war.

“I think we’re going to come to agreements,” Kudlow told Fox News on Wednesday. “I believe that the Chinese will back down and will play ball.”

Yet Trump signaled a harder line in a speech earlier Thursday, saying it was time to stop China from “taking advantage” of America.

‘Fantastic Relationship’

“You have to go after the people who aren’t treating you right,” Trump said in West Virginia. “We’re going to have a fantastic relationship long term with China, but we have to get this straightened out. We have to have some balance.”

Kudlow said Thursday that the administration was involved in “delicate negotiations” that might forestall the need for tariffs. He said the U.S. could still hammer out a deal with Beijing, in part by persuading other major economies to call out the Asian nation for unfair trading practices.

What Our Economists Say…The Trump threat “raises the possibility of an alarming escalation in the trade conflict between the world’s two biggest economies,” Tom Orlik, Chief Asia Economist at Bloomberg Economics, wrote in a note. “It’s difficult to tell the difference between a rhetorical flourish from a president known for bombastic remarks and a meaningful shift in policy.” |

China’s Counterstrike

China countered Trump’s plan announced Tuesday to slap tariffs on 1,333 of the country’s products — such as semiconductors and lithium batteries — by announcing duties on a variety of agriculture products, including soybeans, the second-most-valuable U.S. crop.

The U.S. shipped $14.6 billion of soybeans to China, its biggest buyer, in the last marketing year — more than a third of the entire crop. Agriculture is one of the few sectors of the American economy that runs a trade surplus.

That would hit U.S. farmers hard at a time they are already dealing with depressed crop prices and stagnant values for their land. Concern about a potential trade war already had been rippling through farm states, which are a crucial part of Trump’s political base and a powerful voting bloc in November’s congressional elections.

With the political stakes high, the latest threat from the White House may be just “postulating,” according to Gavin Parry, managing director of Parry International Trading Ltd., who spoke on Bloomberg Television. “A lot of this is very much verbal at the moment,” he said.